Key Takeaways

- Online personal finance coaching offers flexibility and accessibility, allowing you to learn at your own pace from anywhere.

- Starting an online finance coaching business requires a clear understanding of your niche, such as budgeting, investing, or debt management.

- Initial costs for setting up an online coaching business include $5-$20 for a domain, $50-$200 per year for hosting, and $100-$500 for brand design.

- Financial literacy is crucial as many people struggle with budgeting, saving, and managing debt effectively.

- Online coaching provides personalized advice and can be more cost-effective than traditional methods.

Introduction to Online Personal Finance Coaching

In today’s digital age, online personal finance coaching has emerged as a vital resource for those seeking to take control of their financial future. Whether you’re struggling with budgeting, eager to start investing, or looking to get out of debt, online coaching offers tailored guidance right from the comfort of your home. The convenience and flexibility of online platforms have revolutionized the way we approach financial education, making it accessible to a broader audience.

Why Choose Online Coaching

Online coaching stands out for its flexibility and accessibility. Unlike traditional face-to-face sessions, online platforms allow you to access expert advice and resources at any time, from anywhere. This means you can fit financial education into your schedule without the need to travel or adhere to strict timings.

- Learn at your own pace with resources available 24/7.

- Access a wide range of financial experts and coaches globally.

- Benefit from a variety of multimedia resources, including videos, articles, and interactive tools.

Most importantly, online coaching can be more personalized. Coaches often provide tailored advice based on your unique financial situation, helping you achieve your specific goals.

Current Trends and Demand in Financial Education

There is a growing demand for financial education, driven by an increasing awareness of the importance of financial literacy. More people are realizing that managing money effectively is crucial for achieving life goals, such as buying a home, saving for retirement, or funding education. The trend towards digital learning has further fueled the popularity of online finance coaching.

“The global online learning market is expected to reach $375 billion by 2026, highlighting the shift towards digital education.” – Market Research Future

This surge in demand has opened up opportunities for aspiring finance coaches to share their expertise and help others achieve financial freedom.

“Financial Literacy: The Guide to …” from www.annuity.org and used with no modifications.

The Growing Need for Financial Literacy

Financial literacy is more than just understanding how to save or invest; it’s about making informed decisions that can improve your financial wellbeing. Unfortunately, many people lack the knowledge needed to navigate complex financial landscapes, leading to poor money management and increased debt.

Common Challenges in Managing Personal Finances

People often face challenges such as creating and sticking to a budget, understanding investment options, and managing debt. These challenges can be overwhelming, especially when financial jargon and complex terms are involved. Besides that, unexpected expenses and lifestyle inflation can further complicate financial management.

The Impact of Financial Illiteracy

Financial illiteracy can have serious consequences. It can lead to poor credit scores, high levels of debt, and a lack of savings for emergencies or retirement. These issues can cause stress and limit one’s ability to achieve financial goals. To explore ways to improve your financial situation, consider proven methods to earn money from home.

By understanding the basics of personal finance, individuals can make better decisions, reduce financial stress, and improve their overall quality of life. This is where online personal finance coaching can make a significant difference.

“Personal Finance Courses …” from money.usnews.com and used with no modifications.

Benefits of Online Personal Finance Coaching

Online personal finance coaching offers several benefits that can empower individuals to take control of their financial future. By providing personalized advice and convenient access to resources, online coaching can be a game-changer for those seeking financial independence.

Personalized Financial Advice

One of the key advantages of online coaching is the ability to receive personalized advice. Coaches can tailor their guidance based on your specific financial situation and goals. This means you get actionable steps that are relevant to your needs, rather than generic advice.

For example, if you’re looking to pay off debt, a coach can help you create a customized repayment plan that fits your budget and lifestyle.

Convenience and Accessibility

Online coaching is incredibly convenient, allowing you to learn and receive guidance without leaving your home. This accessibility is especially beneficial for those with busy schedules or limited access to in-person resources.

- Access coaching sessions and resources from your computer or mobile device.

- Choose from a wide range of coaches and expertise areas.

- Engage with interactive tools and resources that enhance learning.

Therefore, online coaching not only saves time but also broadens your access to valuable financial knowledge.

Cost-Effectiveness Compared to Traditional Methods

Compared to traditional in-person financial advising, online coaching can be more cost-effective. Many online coaches offer flexible pricing plans, allowing you to choose a package that fits your budget. Additionally, online platforms often provide free resources and tools, further reducing costs.

This affordability makes financial coaching accessible to a wider audience, enabling more people to benefit from expert advice and achieve their financial goals.

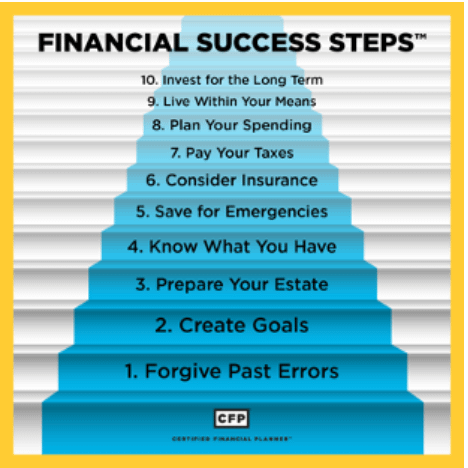

“10 Simple Financial Planning Steps …” from www.letsmakeaplan.org and used with no modifications.

Steps to Start an Online Personal Finance Coaching Business

Starting an online personal finance coaching business requires careful planning and execution. By following these steps, you can establish a successful business that helps others achieve financial freedom while also achieving your own entrepreneurial goals. For those with limited resources, consider exploring budget marketing strategies to effectively reach your target audience.

First, identify your niche and target audience. Consider what specific financial areas you are most knowledgeable and passionate about, such as budgeting, investing, or retirement planning. Understanding your niche will help you tailor your services and marketing efforts effectively.

Next, set up your online platform. This involves creating a professional website where clients can learn about your services and book sessions. You will need to invest in a domain, which typically costs $5-$20, and web hosting, which ranges from $50-$200 per year. Additionally, consider investing $100-$500 in brand design to create a professional and cohesive online presence.

Finally, develop a business model and pricing strategy. Determine how you will structure your services, such as offering one-on-one coaching, group sessions, or online courses. Set competitive pricing that reflects the value of your expertise while remaining accessible to your target audience.

Identifying Your Niche and Target Audience

To kickstart your online personal finance coaching business, the first crucial step is identifying your niche and target audience. Ask yourself: What specific area of finance am I most passionate about? It could be anything from helping people budget effectively, guiding them in investment strategies, or even assisting with debt management. Your niche will shape your services and help you stand out in a crowded market.

Once you have pinpointed your niche, it’s time to define your target audience. Consider who would benefit most from your expertise. Are you aiming to help young professionals just starting their financial journey, or are you targeting retirees looking to manage their savings? Understanding your audience’s needs and challenges allows you to tailor your offerings and marketing strategies effectively.

Setting up Your Online Platform

With your niche and audience in mind, the next step is setting up a professional online platform. This is where potential clients will learn about your services and engage with your content. Start by purchasing a domain name, which typically costs between $5 and $20. Your domain should be easy to remember and reflect your brand.

Next, choose a reliable hosting service, with costs ranging from $50 to $200 per year. A good hosting service ensures your website runs smoothly and remains accessible to clients at all times. Investing in a professional brand design, which can cost between $100 and $500, is also essential. Your website should be visually appealing and user-friendly, creating a strong first impression.

Creating a Business Model and Pricing Strategy

With your platform set up, it’s time to create a solid business model and pricing strategy. Consider the types of services you will offer. Will you provide one-on-one coaching sessions, group workshops, or online courses? Each format has its benefits, and your choice should align with your expertise and the needs of your audience.

Once you’ve decided on your services, set a pricing strategy that reflects the value you provide while remaining competitive. Research what other coaches in your niche are charging and consider offering tiered pricing or packages to accommodate different budgets. Transparency in pricing builds trust and encourages potential clients to take the next step.

“How to Become A Financial Coach – SMI …” from smifinancialcoaching.com and used with no modifications.

Choosing the Right Online Finance Coach

If you’re on the other side of the table and looking to find an online finance coach, choosing the right one is crucial for your financial journey. With so many options available, it can be overwhelming to decide which coach will best meet your needs.

Start by identifying your specific financial goals. Are you looking to save more, invest wisely, or get out of debt? Knowing what you want to achieve will guide you in selecting a coach with the right expertise.

Research potential coaches thoroughly. Look at their qualifications, experience, and the types of services they offer. A coach with a proven track record in your area of interest is more likely to help you succeed.

Qualifications and Certifications to Look For

When evaluating potential coaches, qualifications and certifications are important factors to consider. Look for coaches who hold recognized credentials in personal finance, such as Certified Financial Planner (CFP) or Accredited Financial Counselor (AFC). These certifications indicate a level of professionalism and expertise in the field.

Additionally, consider whether the coach has specialized training in areas relevant to your goals. For example, if you’re interested in investing, a coach with a Chartered Financial Analyst (CFA) designation may be beneficial.

Evaluating Experience and Expertise

Experience matters when it comes to choosing a finance coach. Look for coaches who have a proven track record of helping clients achieve similar goals to yours. Experience often translates to a deeper understanding of financial challenges and effective strategies to overcome them.

Don’t hesitate to ask potential coaches about their background and success stories. A coach who can share real-life examples of client transformations demonstrates their ability to deliver results.

Reading Reviews and Testimonials

Reviews and testimonials from previous clients can provide valuable insights into a coach’s effectiveness. Look for feedback on their communication style, responsiveness, and the impact of their guidance. Positive reviews can give you confidence in your choice, while negative reviews may highlight potential red flags.

Remember, a good coach-client relationship is built on trust and mutual respect. Choose a coach who not only has the expertise you need but also aligns with your values and communication preferences.

Crafting a Personalized Financial Plan

Once you’ve chosen the right coach, the next step is crafting a personalized financial plan. This plan serves as a roadmap to guide you toward your financial goals. A well-structured plan takes into account your current financial status, goals, and the strategies needed to achieve them.

Assessing Current Financial Status

The first step in creating a personalized financial plan is assessing your current financial status. This involves taking a close look at your income, expenses, assets, and liabilities. Understanding where you stand financially provides a baseline for setting realistic goals and tracking progress.

Your coach will likely ask for detailed information about your financial situation, so be prepared to share details about your earnings, debts, and spending habits. Honesty is key to creating an effective plan.

Setting Short-Term and Long-Term Goals

With a clear understanding of your financial status, you can now set short-term and long-term goals. Short-term goals might include creating a budget, building an emergency fund, or paying off high-interest debt. These goals are typically achievable within a year and provide a foundation for more ambitious plans.

Long-term goals, on the other hand, require more time and planning. These might include saving for retirement, purchasing a home, or funding a child’s education. Your coach will help you prioritize these goals and develop a timeline for achieving them.

Strategies for Budgeting and Saving

Budgeting and saving are fundamental components of any financial plan. A budget helps you manage your income and expenses, ensuring you live within your means. Your coach will work with you to create a budget that aligns with your lifestyle and goals.

Effective saving strategies are also crucial. Whether it’s setting up automatic transfers to a savings account or finding ways to cut unnecessary expenses, your coach will provide actionable advice to help you build a strong financial foundation.

Investment Recommendations and Risk Management

Investing is a key strategy for growing wealth and achieving long-term goals. Your coach will guide you in understanding different investment options and their associated risks. They’ll help you develop an investment strategy that aligns with your risk tolerance and financial objectives.

Risk management is equally important. By diversifying your investments and having a clear plan in place, you can minimize potential losses and increase your chances of success.

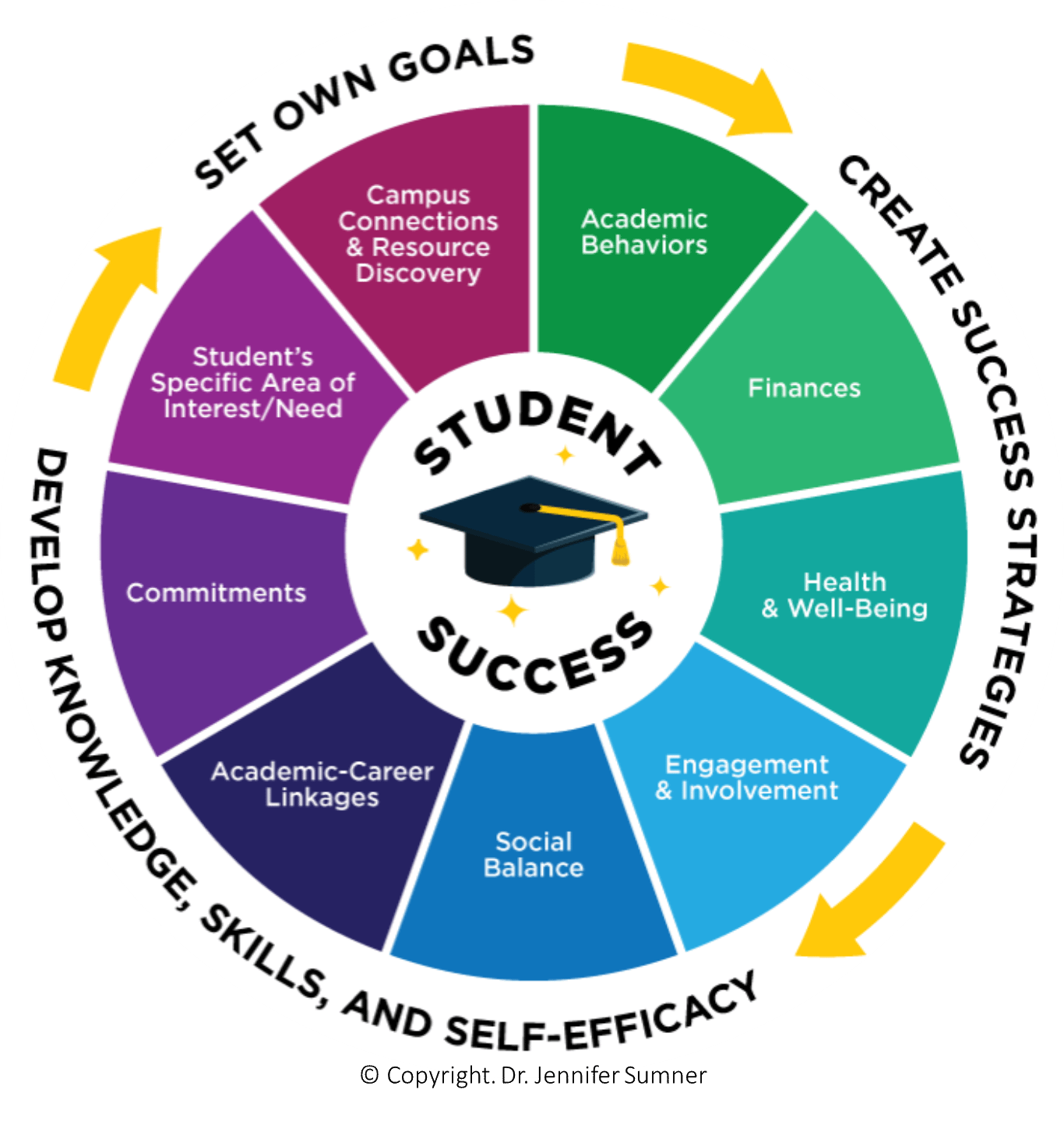

“Academic Success Coaching • Student …” from www.sdes.ucf.edu and used with no modifications.

Success Stories and Real-Life Examples

Success stories from online personal finance coaching illustrate the transformative power of tailored financial guidance. These stories not only inspire but also provide valuable insights into how personalized coaching can lead to significant financial improvements.

Case Studies of Improved Financial Health

Consider Sarah, a young professional who struggled with managing her expenses and saving for the future. Through online coaching, she learned how to create a realistic budget and prioritize her spending. Within a year, Sarah not only paid off her credit card debt but also saved enough for a down payment on her first home.

Another example is Tom, a retiree who was worried about depleting his savings too quickly. With the help of an online coach, Tom developed a sustainable withdrawal strategy and diversified his investment portfolio. As a result, he gained confidence in his financial stability and was able to enjoy his retirement without financial stress.

Lessons Learned From Clients’ Transformations

These success stories highlight several key lessons. First, having a clear financial plan is crucial. Whether you’re saving for a specific goal or managing debt, a well-structured plan provides direction and motivation. For those looking to enhance their financial strategies, exploring budget marketing strategies can offer valuable insights.

Second, personalized guidance makes a difference. Coaches tailor their advice to your unique circumstances, ensuring that you receive relevant and actionable strategies.

Lastly, commitment and consistency are essential. Clients who actively engage with their coaches and follow through on recommendations are more likely to achieve their financial goals.

- Establish a clear financial plan with specific goals.

- Seek personalized advice tailored to your situation.

- Maintain commitment and consistency in your efforts.

Conclusion: Your Path to Financial Freedom

Embarking on a journey to financial freedom through online personal finance coaching can be life-changing. With the right guidance and resources, you can gain control over your finances and work towards achieving your dreams.

Making the Most of Online Coaching

“Success in personal finance is not about how much you earn, but how well you manage and grow your resources.” – Unknown

To make the most of online coaching, approach the process with an open mind and a willingness to learn. Engage actively with your coach and be transparent about your financial situation. This collaboration is key to developing a plan that truly meets your needs.

Additionally, take advantage of the tools and resources provided by your coach. From budgeting apps to investment calculators, these tools can enhance your financial literacy and decision-making skills.

Embracing Continuous Financial Learning

Financial education is a lifelong journey. Even after achieving your initial goals, continue to seek knowledge and improve your financial skills. The financial landscape is ever-changing, and staying informed will empower you to make sound decisions in the future.

Consider joining financial forums, attending webinars, or reading books on personal finance to expand your understanding. By embracing continuous learning, you can adapt to new challenges and seize opportunities for growth. For instance, you might explore budget marketing strategies to enhance your financial knowledge.

Frequently Asked Questions (FAQ)

As you consider online personal finance coaching, you may have questions about its effectiveness and how it compares to traditional methods. Here are answers to some common questions:

What is the average cost of online personal finance coaching?

The cost of online personal finance coaching varies depending on the coach’s experience and the services offered. On average, you can expect to pay between $50 and $150 per hour. Some coaches offer package deals or subscription models that provide ongoing support at a reduced rate.

It’s important to consider the value of the guidance and the potential financial benefits when evaluating the cost of coaching.

How is online coaching different from traditional financial advisors?

Online coaching offers greater flexibility and accessibility compared to traditional financial advisors. You can engage with your coach remotely, access resources at any time, and tailor the coaching experience to fit your schedule.

Can online finance coaches help with debt management?

Yes, many online finance coaches specialize in debt management and can provide strategies to help you pay off debt efficiently. They can assist in creating a repayment plan, negotiating with creditors, and finding ways to reduce interest payments.

Is online personal finance coaching effective for beginners?

Absolutely. Online coaching is well-suited for beginners as it provides foundational knowledge and step-by-step guidance. Coaches can help you build a strong financial base, understand key concepts, and develop healthy money habits.

For beginners, the personalized approach of online coaching ensures that you receive the support and encouragement needed to succeed.

What tools do online finance coaches use to assist clients?

Online finance coaches use a variety of tools to assist clients, including budgeting apps, financial planning software, and investment platforms. These tools help clients track their progress, visualize their financial goals, and make informed decisions. For those working with limited resources, exploring budget marketing strategies can be particularly beneficial.

Additionally, coaches may provide access to educational materials, such as articles, videos, and webinars, to enhance clients’ financial literacy.

Starting an online personal finance coaching business can be a rewarding venture. It allows you to share your expertise with others while helping them achieve their financial goals. To get started, you’ll need to identify your target audience and develop a comprehensive business plan. Consider using budget marketing strategies to effectively promote your services without overspending. Additionally, creating a user-friendly website and utilizing social media platforms can help you reach a wider audience. Remember, the key to success is providing valuable and actionable advice that resonates with your clients.